The prediction comes after a very healthy stock close for Microsoft on Friday, with shares trading at up to $87. This gave it a market value of $680 billion, and that number has since increased to $722 billion. Comparatively, Apple sits at $876 billion, so Microsoft still has a way to go. However, Morgan Stanley believes that the companies presence in the growing cloud market will grant it a large advantage. “With Public Cloud adoption expected to grow from 21% of workloads today to 44% in the next three years, Microsoft looks poised to maintain a dominant position in a public cloud market we expect to more than double in size to $250 billion dollars,” said the analysts.

The Nadella Effect

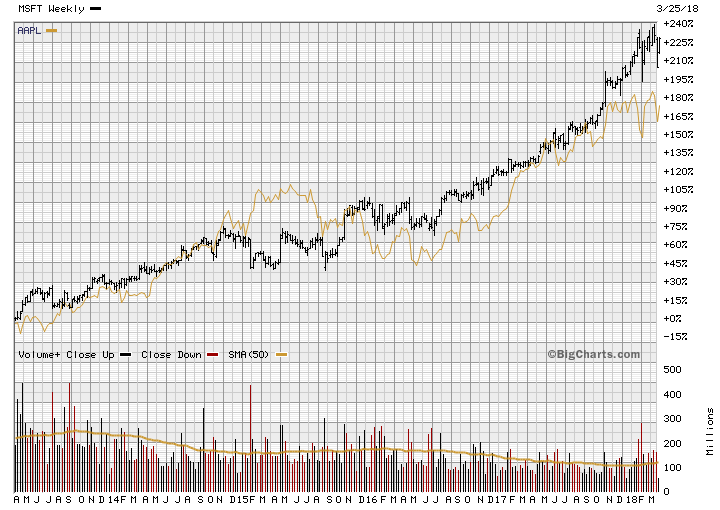

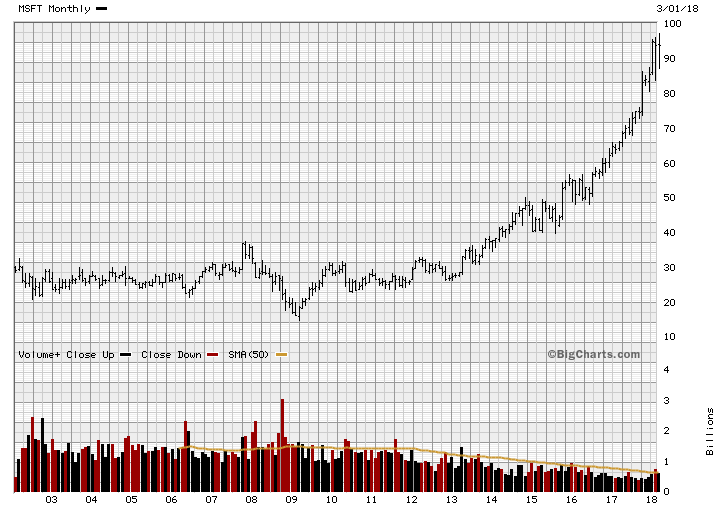

As such, analysts expect Microsoft’ sales and profit to continue growing at a 10% clip for the next few years, marking the turnaround for the company. In 1985 and under Bill Gates, it was trading at $0.10, followed by a meteoric rise from 1995–1999 with the release of Windows 95, Internet Explorer, and MSN. The company’s share price has risen from $3.92 at the start of 1995 to $58.75 at the end of 1999. Things began to take a turn with the appointment of Steve Ballmer as CEO in early 2000, falling back down to $27.22 by the end of the year. From there, things largely stagnated until 2013, when an upward trend began before Satya Nadella took over in 2014.

From there, the company skyrocketed. In two years, it had passed its all-time high of $58.75 and has seen a sharp incline since. It’s been a fantastic few years for the company, and Morgan Stanley believes Office 365 and Azure are vital if it’s to become a trillion dollar company. Analysts say the number of corporate users of Office 365 could double from 105 million to 204 million by the end of 2020, increasing revenue from $10.7 billion to $25.6 billion. Azure is expected to take a much sharper growth, from $3.9 billion in 2017 to $21.6 billion in 2020. However, Microsoft could hit $1 trillion before then due to an increased focus on Xbox, if its tax rate drops, or if it purchases its own stock. Essentially, there are a lot of factors in such an estimation, and they should always be taken with a grain of salt. However, with Microsoft barely considered a player three years ago, it’s hard to argue against its success.